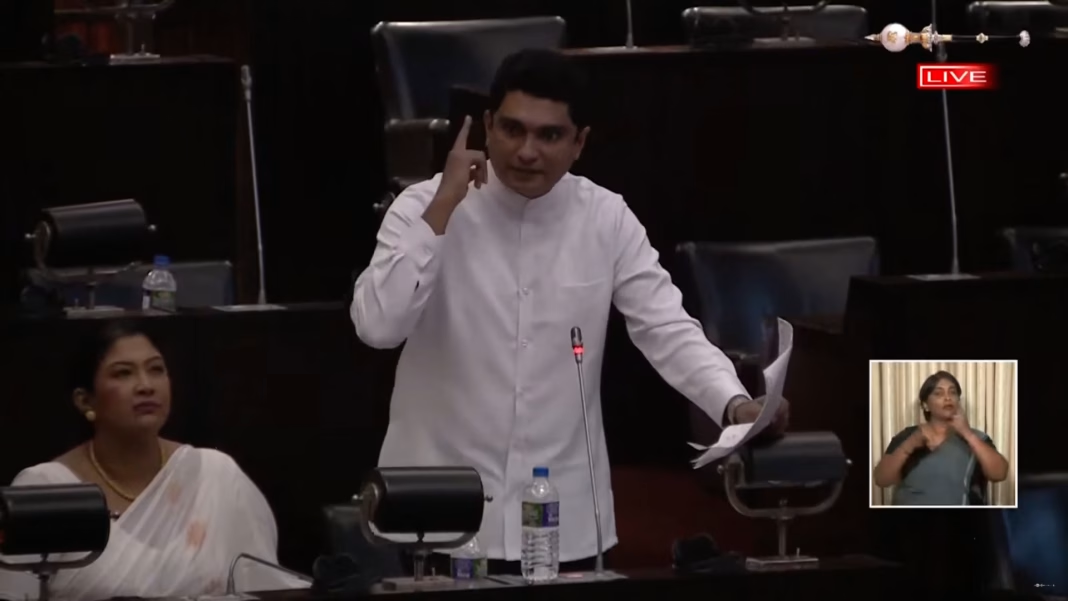

A statement made by an opposition Member of Parliament regarding the government’s tender to purchase 100 low-floor buses has sparked widespread debate on social media. Many are accusing the tender process of being deliberately manipulated to prevent the provision of comfortable public transport services.

Samagi Jana Balawegaya MP Prasad Siriwardana revealed in Parliament that the core issue lies in a tender condition that allegedly favors imported buses by excluding local bus assemblers.

The Rs. 6 Billion ‘Turnover’ Condition Under Scrutiny

The two main local companies vying for this tender are Lanka Ashok Leyland PLC, which locally assembles Ashok Leyland buses, and DIMO PLC, which imports TATA buses.

According to the tender condition, a bidding company must demonstrate an annual turnover exceeding Rs. 6 billion in at least three of the past five years.

- Lanka Ashok Leyland has exceeded this limit in two years, but in one year, its income was comparatively lower Rs. 5.4 billion.

- DIMO PLC, which imports vehicles of various brands in addition to TATA, boasts an annual turnover ranging from Rs. 40-50 billion.

This disparity has fueled strong suspicions that the condition was intentionally included to disqualify Ashok Leyland from the tender process.

Stock Market Behavior Raises Eyebrows

While working capital is typically more crucial than annual turnover for large bus orders, the focus in this tender has been heavily placed on the income limit.

The behavior of stock prices in the wake of these tender conditions has also raised suspicion:

- Before the conditions were announced, investors expected Ashok Leyland to secure the tender, causing its share price to rise.

- Following the announcement of the tender conditions, DIMO PLC’s share price began to climb significantly, recording an unusual 49% surge today (October 9th). (It’s noteworthy that the primary shareholders of DIMO are Dhammika Perera’s Hayleys company and family members of its CEO.)

Critics are questioning the connection between this abnormal stock market activity and the Rs. 6 billion ‘turnover’ condition, calling for an immediate investigation into the tender process.

While Lanka Ashok Leyland technically could have submitted a joint venture bid with its Indian parent company, the opposition is questioning whether this condition was a deliberate tactic to exclude local assemblers.