By Visvalingam Muralithas

Vietnam has risen from the ashes of war to become one of Asia’s most dynamic and resilient economies. Meanwhile, Sri Lanka, despite similar beginnings, continues to face economic stagnation, fiscal distress, and developmental setbacks. The contrasting outcomes of these two nations—both of which experienced protracted conflicts, colonial rule, and periods of political turbulence—offer vital insights into the ingredients of sustainable post-conflict recovery and long-term economic success.

Over the past few decades, Vietnam has undergone a stunning transformation, rising from one of the poorest nations in Southeast Asia to a dynamic global economic force. This remarkable shift is not merely a tale of resilience but a testament to the country’s strategic policy choices, market-oriented reforms, and its ability to navigate and adapt to global economic trends. Today, Vietnam stands as a shining example of economic success, garnering the attention of governments, investors, and economists worldwide.

Vietnam has an estimated population of about 100 million in 2024, making it one of Southeast Asia’s most populous countries. It has a young and diverse population, with the Kinh ethnic group making up the majority. Population density is especially high in urban centers like Ho Chi Minh City and Hanoi, contributing to a dynamic workforce. The country spans 331,210 square kilometers and features diverse geography, including mountains, forests, and a long coastline along the South China Sea, which supports its agricultural success and natural resource development.

Sri Lanka, on the other hand, has a much smaller population of 22 million in 2024. Its population is ethnically diverse. The country has an aging population, with an increasing number of elderly citizens. Its land area is 65,610 square kilometers, and it is known for its rich biodiversity, including tropical rainforests, beaches, and mountains. Sri Lanka’s strategic location in the Indian Ocean has significantly influenced its history and economy.

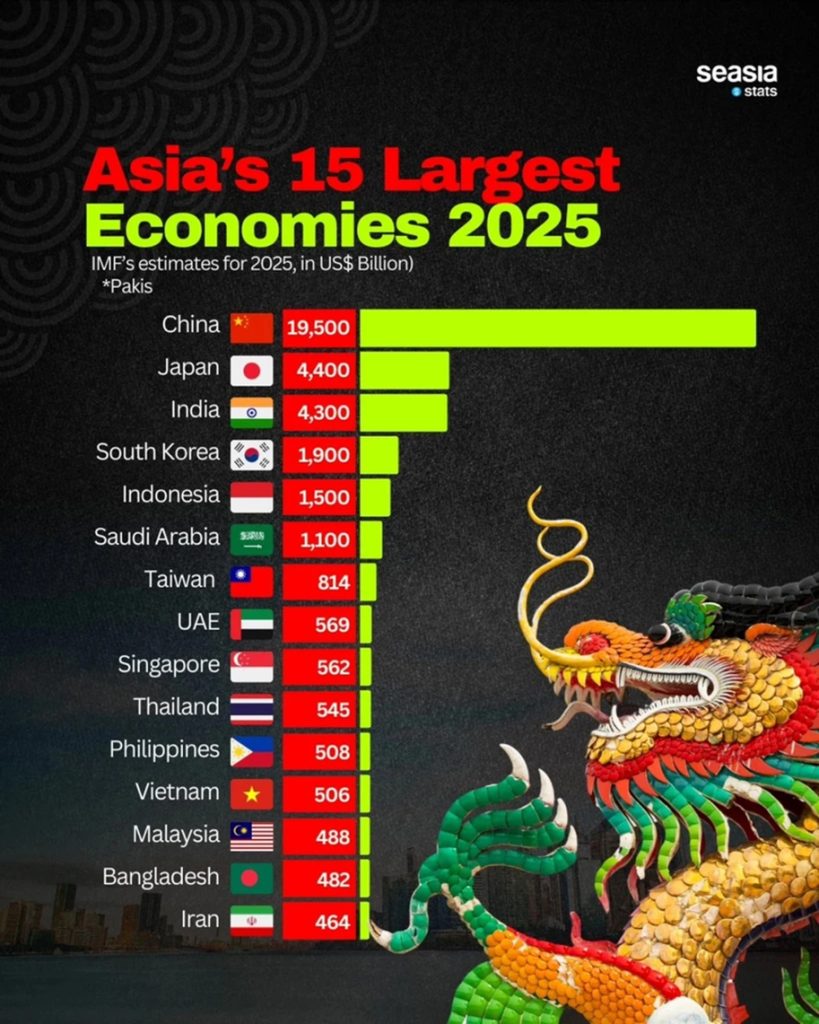

Asia’s 15 largest economies

Vietnam has been ranked 12th among Asia’s 15 largest economies by Seasia Stats, with a projected GDP of 506 billion USD in 2025. The ranking highlights Vietnam’s rapid growth, largely fueled by booming manufacturing and foreign investment. With an expected 7% GDP growth in 2024, Vietnam stands out as one of the fastest-growing economies globally. While China, Japan, and India remain Asia’s top three economies, Vietnam’s rise places it just behind Thailand and the Philippines, and ahead of several other regional players. Indonesia leads Southeast Asia with a projected GDP of 1.5 trillion USD, followed by Singapore, Thailand, and the Philippines.

In contrast, Sri Lanka ended its 26-year civil war in 2009. While the end of conflict created expectations of a rapid economic revival, the post-war years were marked by inconsistent policy, rising debt, and missed opportunities for structural reform.

Reform to Resilience

Vietnam’s economic progress is nothing short of extraordinary. In 1986, real GDP per capita stood at under US$700, by 2023, it had climbed to nearly US$4,500 (constant USD). The country has consistently maintained GDP growth rates between 6% and 7% for much of the last two decades, with projections of 6.5% growth in 2025.

Key drivers of Vietnam’s success include:

- Market-Oriented Reforms: Đổi Mới ushered in a shift from a centrally planned economy to one open to private enterprise and foreign investment.

- Export-Led Growth: Vietnam became a global manufacturing hub, exporting textiles, electronics, and agricultural products.

- Foreign Direct Investment (FDI): Investor-friendly policies attracted multinational corporations like Samsung, Intel, and Nike.

- Education and Human Capital: Vietnam prioritized universal primary education, with high secondary enrollment and a skilled, youthful workforce.

- Stable Policy Environment: Consistent economic policies and long-term planning reassured investors and partners.

Vietnam also demonstrated resilience during global crises. Despite the COVID-19 pandemic and disruptions in global trade, its economy bounced back swiftly, supported by a diversified industrial base and prudent macroeconomic management.

Sri Lanka

- Inconsistent Economic Policy: Shifts between socialist and market-oriented approaches have created uncertainty, deterring long-term investment.

- Over-Reliance on Imports and Debt: A failure to develop an export-driven economy left Sri Lanka vulnerable to trade imbalances. Heavy reliance on foreign debt led to a sovereign default in 2022.

- Weak FDI Performance: In 2023, Sri Lanka attracted just over US$1 billion in FDI—compared to Vietnam’s US$36 billion—largely due to governance issues and infrastructure deficits.

- Underdeveloped Industrial Sector: Despite the presence of Board of Investment (BOI) zones, industrial growth has been constrained by bureaucracy, poor logistics, and underinvestment.

- Macroeconomic Crisis: In 2022, Sri Lanka experienced its worst economic crisis in decades, with inflation exceeding 70%, fuel and food shortages, and a complete collapse of foreign reserves.

While Vietnam built strong buffers and diversified its economy, Sri Lanka remained overly dependent on volatile sectors like tourism and remittances, both of which collapsed during the pandemic.

1. Policy Stability and Vision

Vietnam’s consistent, long-term economic strategy—grounded in market liberalization—was key to investor confidence. Sri Lanka must establish a coherent economic vision that transcends political cycles.

2. Export and Industrial Policy

Vietnam transformed into a manufacturing powerhouse. Sri Lanka must shift from consumption-led growth to export-oriented development, particularly in high-value sectors.

3. Human Capital and Skills

Vietnam aligned education with industry demand. Sri Lanka needs to modernize its education system, emphasizing vocational training, STEM, and digital skills.

4. Governance and Decentralization

Vietnam empowered local governments to implement policies and attract investment. Sri Lanka could benefit from devolving economic decision-making to the provincial level.

5. Debt Discipline and Fiscal Reform

Vietnam avoided debt distress through disciplined fiscal management. Sri Lanka must commit to responsible borrowing, tax reform, and reducing wasteful expenditure.

Comparative Snapshot (2024)

| Indicator | Vietnam | Sri Lanka |

| Population | ~100 million | ~22 million |

| GDP (Projected, 2025) | US$506 billion | ~US$85 billion |

| GDP Growth (2024) | 6.5% | ~2–3% |

| FDI Inflows (2023) | US$36 billion | ~US$1 billion |

| External Reserves | US$95 billion | ~US$4–5 billion |

| IMF Program | None | Ongoing (since 2023) |

| Primary Export Sectors | Electronics, garments | Tea, textiles, tourism |

| Debt-to-GDP Ratio | ~40% | Over 100% (pre-default) |

Conclusion

Vietnam and Sri Lanka exemplify how different policy paths can shape national outcomes. Vietnam’s success story is built on pragmatism, stability, and openness to global markets. Sri Lanka’s setbacks stem from internal divisions, erratic policy, and fiscal indiscipline.

Yet, Sri Lanka’s future is not predetermined. With the right reforms—rooted in transparency, innovation, and economic inclusiveness—the country can regain lost momentum. Vietnam’s journey offers a powerful blueprint, but ultimately, Sri Lanka must chart its own course with clarity, courage, and commitment.

Writer

Visvalingam Muralithas is a researcher in the legislative sector, specializing in policy analysis and economic research. He is currently pursuing a PhD in Economics at the University of Colombo, with a research focus on governance, development, and sustainable growth.

He holds a Bachelor of Arts in Economics (Honours) from the University of Jaffna and a Master’s degree in Economics from the University of Colombo. His academic background is further strengthened by postgraduate diplomas in Education from the Open University of Sri Lanka and in Monitoring and Evaluation from the University of Sri Jayewardenepura.

In addition to his research work, Muralithas has contributed to academia by teaching economics at the University of Colombo and the Institute of Bankers of Sri Lanka (IBSL) and has also gained industry experience as an investment advisor at a stock brokerage firm affiliated with the Colombo Stock Exchange.

📧 Email: [email protected]

📞 Phone: +94 778135971